Talk of federal $2,000 payments arriving in January 2026 has sparked widespread attention across the U.S. For households managing rising costs, even a one-time payment can make a meaningful difference. While final rules depend on federal legislation and agency guidance, beneficiaries can take practical steps now to avoid delays, missed payments, or scams.

Federal $2000 Payments Arriving January

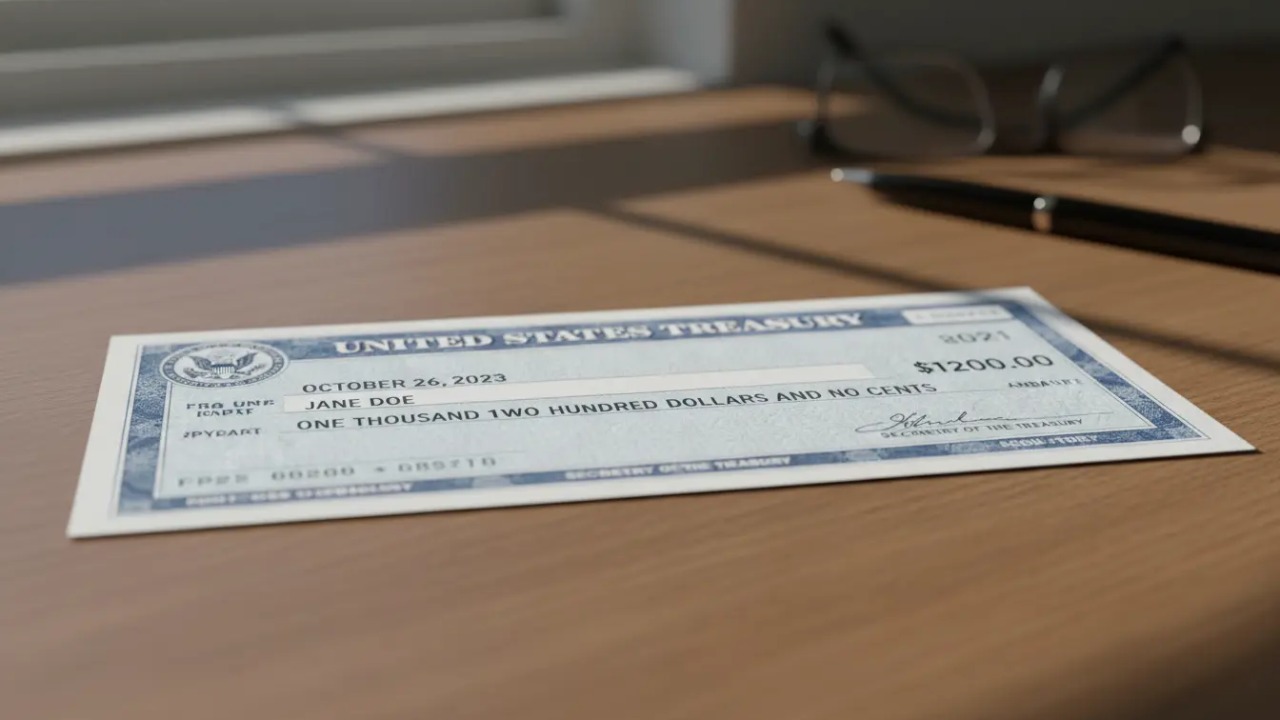

The proposed $2,000 federal payment is structured as a targeted relief or adjustment payment, not a lottery-style giveaway. These payments are usually tied to income limits, tax filing status, or enrollment in federal benefit programs. Distribution is typically handled by agencies such as the IRS, Social Security Administration, or Veterans Affairs, depending on how the law is written.

While some deposits may begin processing in late December 2025, many beneficiaries are expected to see funds credited in January 2026.

Overview

| Category | Details |

|---|---|

| Expected Payment Amount | Up to $2,000 per eligible individual |

| Likely Payment Window | Late December 2025 to January 2026 |

| Eligibility Basis | Income limits, tax filing, or benefit enrollment |

| Delivery Methods | Direct deposit, paper check, or debit card |

| Managing Agencies | IRS, SSA, VA, or related federal agencies |

| Official Reference | https://www.irs.gov |

Eligibility Criteria

Eligibility criteria are determined by federal law and may vary slightly by program. In most cases, qualification is based on records already on file with the government.

Common eligibility factors include:

- Adjusted Gross Income limits from the most recent tax return

- U.S. citizenship or qualifying resident status

- Enrollment in federal benefits such as Social Security, SSI, SSDI, or VA programs

- Filing status and dependent information

Beneficiaries should rely only on official agency guidance when confirming eligibility.

How to Check Your Eligibility Status

Most federal agencies provide online portals where individuals can review eligibility, update profiles, and view notices. When checking, keep your Social Security number, tax return details, or benefit ID information available.

Some agencies also offer automated phone systems or mailed notices explaining whether you qualify and how the payment will be issued.

How Federal $2,000 Payments Will Be Delivered

Delivery methods depend on the information already on file with the administering agency. Direct deposit is strongly encouraged, as it reduces delays and lost payments.

Common delivery options include:

- Direct deposit to your bank account

- Paper checks mailed to your address

- Prepaid debit cards in limited cases

If your banking or mailing information has changed recently, updating it before December 2025 is critical.

How to Update Your Payment

Updating your details early helps avoid rejected deposits or returned checks. Only use verified government portals.

Steps usually include:

- Signing into the official agency account

- Navigating to profile or payment settings

- Updating bank routing and account numbers or mailing address

- Saving confirmation for your records

Never provide personal or banking information in response to unsolicited calls or emails.

What to Do If You Don’t Receive the Payment

If January 2026 arrives and your payment has not, start with the agency’s official status tracker. Many portals show whether a payment is “processing,” “sent,” or “returned.”

If the payment shows as sent but not received:

- Verify your payment method and address

- Allow standard processing time, usually 7–21 days

- Contact the agency using its published phone number

- Request a payment trace if advised

Prompt action helps resolve issues faster.

FAQs

Q:- Will everyone receive the $2,000 federal payment in January 2026?

A – No, payments are targeted and depend on eligibility rules set by federal law.

Q:- Is direct deposit faster than a paper check?

A – Yes, direct deposit is typically the quickest and most secure option.

Q:- Are federal $2,000 payments taxable?

A – Tax treatment depends on the legislation, so official IRS guidance should be checked.